Greetings, dear readers! Today, I would like to discuss an exciting tool that has taken the financial world by storm – Robinhood. As I perused through the reviews of Robinhood, my curiosity was piqued by the various opinions about this trading platform.

Robinhood was established in 2013 and has gained immense popularity as a broker that provides commission-free trading services for stocks, exchange-traded funds, options, gold, and cryptocurrencies. The platform was founded with the vision of democratizing the financial system, and it has become one of the top brokers, with millions of users preferring it as their go-to trading app.

However, as I delved deeper into the various reviews, I found that opinions about Robinhood were divided. While some lauded its intuitive user interface and commission-free trading, others criticized it for eliminating competitive edge due to changes in business. This diversity of opinions intrigued me, and I set out to analyze and understand the different perspectives on Robinhood. So, let us embark on this journey together and uncover what Robinhood has to offer!

Register with Robinhood today and use the free trial verion.

What is Robinhood?

Robinhood is a popular commission-free online brokerage platform that enables traders to invest in various financial instruments such as stocks, exchange-traded funds (ETFs), options, and cryptocurrencies. Additionally, the platform allows its users to trade with a maximum leverage of 2:1, which can be useful for those looking to amplify their returns. However, it is important to note that leveraged trading can be risky, especially when it comes to trading cryptocurrencies, as the market can be highly volatile.

Robinhood has a minimum spread of 0.3% for stock trading, which means that traders can benefit from a competitive trading environment with tight spreads. In terms of margin requirements, each stock, crypto, or options owned by an investor has its own maintenance requirement, which is based primarily on the asset’s volatility. Additionally, Robinhood Gold margin service provides traders with the ability to use up to $1,000 of margin to purchase more stock than they could with their cash balances.

Robinhood allows its users to open both long and short positions on assets through its platform. Going long on an asset means that a trader is betting on the asset to increase in value over time. On the other hand, shorting an asset means that an investor is bearish on the price of an asset and sells it in order to buy it back at a cheaper rate later. This flexibility allows traders to make informed decisions based on their market outlook.

With a withdrawal limit of $50,000 per business day and a deposit limit of $50,000 per business day, Robinhood provides traders with an efficient and effective way to move funds in and out of their trading account. It is worth noting that Robinhood generates revenue by investing clients’ funds at a higher interest rate and through its premium services, Robinhood Gold and debit card fees. This business model allows the platform to offer commission-free trading while still generating income.

Robinhood’s simple design and focus on the basics have made it popular among younger, tech-savvy investors. Its commission-free trading model and access to a wide range of trading instruments have disrupted the brokerage industry, and its recent introduction of new services such as a cash management account and recurring investment feature further demonstrate the platform’s commitment to innovation and customer satisfaction.

Summary Table

| Robot Name | 🤖 | Robinhood |

| Robot Type | 👾 | Crypto Trading Robot |

| Minimum Deposit | 💸 | $250 |

| Is It a Scam or Legit? | ✅ | Legit |

| Claimed Win Rate | 🚀 | 84% |

| Trading Fees | 💰 | None |

| Account Fees | 💰 | None |

| Deposit/Withdrawal Fees | 💰 | None |

| Software cost | 💰 | Free |

| Withdrawal Timeframe | ⌛ | 24 hours |

| Number of Cryptocurrencies Supported | #️⃣ | 50 |

| Supported Cryptocurrencies | 💱 | BTC, ETH, LTC, XRP |

| Supported Fiats | 💲 | USD, EUR, GBP |

| Leverage | 📊 | 5000:1 |

| Social Trading | 👩🏫 | Yes |

| Copy Trading | 📋 | Yes |

| Native Mobile App | 📱 | No |

| Free Demo Account | 🖥️ | Yes |

| Customer Support | 🎧 | Live Chat |

| Verification required | ✅ | Introductory Phone Call / KYC |

Robinhood Platform Key Features

- Dividend Reinvestment Program: Our tool offers a Dividend Reinvestment Program, enabling you to reinvest any profits you get back into your initial investment. This feature allows you to compound your returns over extended periods of time and offers a useful option for long-term investors seeking to maximize their profits.

- Recurring Payments: Our tool provides a recurring payment option, allowing users to make regular payments to a specific security automatically. With this feature, you can easily put away a predetermined percentage of each of your paychecks from your bank account into Bitcoin every single month. This is a useful option for those interested in investing for the long term and desiring to Dollar-Cost Average their assets over extended periods of time.

- Robinhood Gold: Our premium service, Robinhood Gold, is tailored to meet the needs of experienced traders. It offers access to premium research information on over 1,500 different companies through Morningstar. Additionally, users of Robinhood Gold have access to Level 2 Quotes and margin loans, enabling them to place larger orders after conducting thorough research into the company. With our tool, you can make a trade of up to $1,000 more than the capital that you have without risking any more of your own money, which helps traders to magnify their profits on any given trade.

- Low Interest Rates: Any additional margin that you borrow in order to use it on the platform will incur a low 2.5% annual interest charge. This is a reasonable pricing structure, and these interest payments are billed annually to your account. It’s essential to keep in mind that any account that plans to sign up for Robinhood Gold and make trades on margin has to have a minimum balance of $2,000 to meet the margin requirements.

Bitcoin

$64,247.73

NEO

$17.27

Ethereum

$3,628.90

Register with Bitcoin Lifestyle today and use the free trial version.

Robinhood Platform Technical Overview

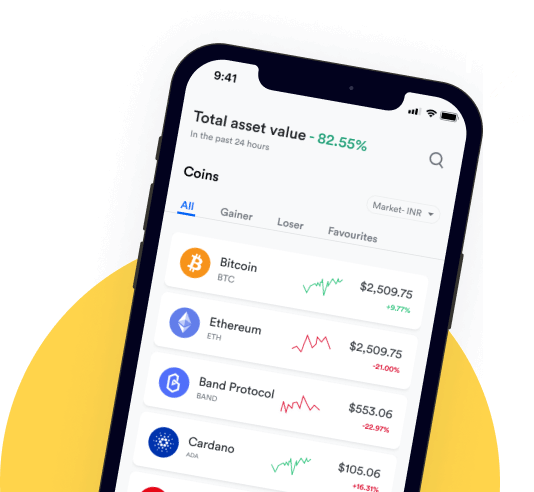

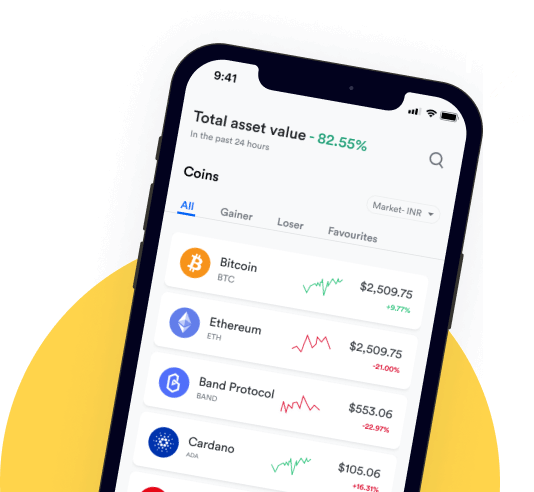

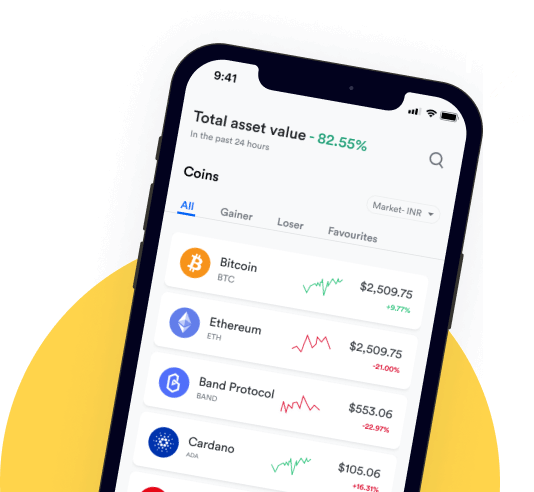

Robinhood is an easy-to-use trading platform designed for both novice and experienced traders. The platform offers a range of assets, including stocks, options, ETFs, and cryptocurrencies.

Traders can purchase any of the seven cryptocurrencies that are currently supported by Robinhood, including Bitcoin, Bitcoin Cash, Bitcoin SV, Dogecoin, Ethereum, Ethereum Classic, and Litecoin. To get started, traders can deposit funds into their account using a bank transfer or debit card.

Robinhood offers various trading options, including limit orders, stop-loss orders, and market orders. Traders can choose the order type that best suits their trading strategy and manage their risk effectively. Additionally, the platform provides real-time market data and price charts, enabling traders to track the performance of their cryptocurrency assets and make informed trading decisions.

Robinhood offers competitive spreads on all of its cryptocurrency assets, ensuring that traders receive the best value for their trades. Traders can also use margin trading to control larger positions with a smaller initial investment. However, it’s essential to remember that margin trading involves additional risks, and traders should only use it if they fully understand the risks involved.

The platform is designed to be user-friendly, with an intuitive interface that makes it easy for traders to navigate and execute trades quickly and efficiently. Additionally, Robinhood offers customer support 24/7, ensuring that traders can get the help they need when they need it.

Is Robinhood Safe?

The safety and security of a trading platform are crucial aspects that any potential user should consider before starting to trade. Robinhood is a legitimate and well-established platform that provides users with a high level of security when it comes to protecting their funds and personal information.

One of the essential security features offered by Robinhood is biometric authentication. This feature allows users to log into the platform using their fingerprint or face recognition, providing an additional layer of security against unauthorized access. Robinhood also allows users to set up a custom six-digit PIN as an alternative login option.

To prevent cyber-attacks and hacking, Robinhood employs a two-factor authentication process that requires users to enter a unique code generated by the Google Authenticator app to access their accounts. This ensures that only the owner of the account can access it and prevents anyone else from withdrawing funds or making trades on their behalf.

Robinhood also uses hot storage for daily operations and cold storage for most coins. This means that the majority of user funds are stored offline in a cold storage facility that is completely cut off from the internet. This provides users with an additional layer of security against cyber-attacks and hacking.

In addition to its security features, Robinhood is also a member of the SIPC, which means that users’ deposits are protected up to $500,000 or $250,000 if the claim is made for cash. This provides users with peace of mind, knowing that their funds are protected in case of any unexpected events.

In conclusion, Robinhood is a safe and legitimate trading platform that provides users with a high level of security and protection for their funds and personal information. With its biometric authentication, two-factor authentication, and cold storage for most coins, users can rest assured that their funds are safe and secure on the platform.

Is Robinhood Scam or Legitimate?

Robinhood is a legitimate trading platform that has grown in popularity over the years. However, one major concern that many traders have is whether the platform is safe to use.

The good news is that Robinhood has put in place a variety of measures to ensure the safety of users’ funds and data. First and foremost, the platform uses biometric authentication and two-factor authentication to ensure that only authorized users can access their accounts. This provides an additional layer of security to protect against cyber-attacks and unauthorized access.

Additionally, Robinhood is a member of the SIPC, which provides protection for deposits made by users onto the platform. This means that if there is any issue with the platform or if it goes bankrupt, users’ funds will be protected up to $500,000 or $250,000 if the claim is made for cash.

Furthermore, Robinhood uses hot storage and cold storage to store funds and cryptocurrencies, respectively. Hot storage is used for daily operations, while cold storage is used for long-term storage. Most cryptocurrencies are stored in a cold storage facility that is completely cut off from the internet, providing an additional layer of security.

Robinhood is a safe trading platform that takes users’ security seriously. By using biometric authentication, two-factor authentication, and the SIPC’s protection, Robinhood ensures that users’ funds and data are protected from cyber-attacks and other risks. The use of hot storage and cold storage for funds and cryptocurrencies also provides an additional layer of security, making Robinhood a safe and reliable platform for traders to use.

Register with Robinhood today and use the free trial verion.

Robinhood Pros & Cons

The Robinhood trading platform is a popular app among both new and experienced investors due to its easy-to-use interface and variety of assets to trade. However, as with any platform, there are also cons associated with using Robinhood. Let’s explore some of the key pros and cons of the Robinhood trading platform.

- User-Friendly App: The mobile app is easy to navigate and has been designed to focus on simplicity, making it appealing to new investors. Advanced traders can customize the interface to fit their preferences.

- Large Asset Variety: Robinhood offers access to a variety of asset classes, including stocks, ETFs, options, and most major cryptocurrencies. This makes it a one-stop-shop for traders.

- Fractional Purchases: Robinhood allows investors to buy fractional shares of assets, making it accessible to investors who might not be able to afford the full price of expensive assets.

- Cash Management Account: Robinhood offers cash management features, allowing investors to earn interest on their idle cash and easily withdraw money from the 75,000+ ATMs within the Robinhood network.

- Educational Resources: The platform offers a suite of educational resources, including video classes and exams, to educate users about cryptocurrency trading and the latest developments in the space.

- No Account Minimum: Robinhood doesn’t require an account minimum deposit, making it ideal for new investors who don’t want to risk a lot of capital into their investments.

- Highly Regulated: Robinhood is a publicly listed exchange, and as such, is one of the most highly regulated exchanges, offering investors a safe platform in which to trade their cryptocurrency assets.

- Limited Asset Variety: Robinhood’s cryptocurrency offering is limited compared to other platforms, and it does not support mutual funds, commodities, or bonds.

- Lack of Diverse Funding Options: Robinhood does not support credit or debit cards as payment options, making it less attractive to some users.

- Trading Restrictions: Robinhood’s PFOF model can lead to outages and other similar problems, as we saw last year when the firm froze trading associated with GameStop shares. Additionally, several investors complained that their positions were force-liquidated by the platform against their consent.

- Weak Customer Support: Robinhood’s customer service is known for being quite poor and unresponsive, especially when it comes to solving major security issues or serious customer queries.

- No PFOF Data: Robinhood doesn’t publish Payment For Order Flow statistics, making it difficult to compare performance and execution times with other brokers.

- No Retirement Accounts: Robinhood does not support IRA or retirement accounts, making it less appealing to users who are looking to save for their future.

How to start trading with Robinhood

- Download the Robinhood app: The Robinhood app is available for download on both Android and iOS devices. Download and install the app on your phone.

- Create an account: Once you’ve installed the app, you’ll need to create an account. Tap on “Sign Up” and enter your personal information, such as your name, email address, and social security number. You’ll also need to create a username and password.

- Verify your identity: In order to comply with financial regulations, Robinhood will need to verify your identity. You can do this by providing a government-issued ID, such as a driver’s license or passport.

- Add funds to your account: Once your account is verified, you can add funds to your account. You can link your bank account to your Robinhood account and transfer funds into your account. You can also set up recurring deposits.

- Choose your investments: With your account funded, you can now start trading. Robinhood offers a variety of investment options, including stocks, options, cryptocurrencies, and ETFs. Use the app to research different investments and decide what you want to trade.

- Place your trade: Once you’ve chosen your investment, you can place a trade. Enter the ticker symbol of the investment you want to trade and select whether you want to buy or sell. Enter the amount you want to trade and review the details before submitting your trade.

- Monitor your investments: Keep an eye on your investments to see how they are performing. You can use the Robinhood app to track your portfolio and make adjustments as needed.

How it works

As we dive into how this bitcoin trading tool works, it is essential to understand that the platform was designed with simplicity in mind. The tool leverages cutting-edge technology that is user-friendly and is available on both Android and iOS devices.

To start using the platform, you first need to download the app and create an account. The account creation process is straightforward and involves providing basic personal information and creating a password. Once you have verified your account, you can link it to your bank account and start trading.

The trading platform offers a variety of assets, including stocks, exchange-traded funds (ETFs), options, and cryptocurrencies. One of the unique features of the platform is that it offers fractional purchases, which allows users to buy a small fraction of an asset, making it accessible to all.

The platform’s cryptocurrency trading features are quite robust, offering users access to eleven cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and others. Additionally, the trading fees are zero, which means that users can buy and sell cryptocurrencies without any transactional costs.

The platform operates on a Payment for Order Flow (PFOF) model, where orders are routed to market makers who execute the trades. This approach allows the platform to offer zero transactional fees while generating revenue from the market makers. However, users should note that this model has been criticized for potential conflicts of interest.

Security is a top priority for the platform, and as such, it has implemented several measures to keep users’ funds secure. The platform stores user funds in cold storage, which is an offline storage system, making it less vulnerable to hacking. Additionally, it offers two-factor authentication (2FA) and uses SSL encryption to secure user data and transactions.

In summary, this bitcoin trading tool is a user-friendly platform that utilizes innovative technology to provide users with an easy way to trade assets, including cryptocurrencies, with zero trading fees. It operates on a PFOF model, offers fractional purchases, and has implemented robust security measures to protect user funds and data.

Bitcoin

$64,247.73

NEO

$17.27

Ethereum

$3,628.90

Register with Bitcoin Lifestyle today and use the free trial version.

Robinhood FAQ

Robinhood is a mobile app that allows users to trade stocks, options, and cryptocurrencies without paying commissions.

Yes, Robinhood is a good option for beginners due to its simple and user-friendly interface.

Yes, Robinhood is a good choice for investing because of its commission-free trading on stocks, options, ETFs, and cryptocurrencies.

No, Robinhood is a legitimate and regulated organization overseen by the Securities and Exchange Commission (SEC).

Yes, it is possible to make money on Robinhood through trading, but it also carries the same risks as any other platform.

Robinhood is regulated by the Securities and Exchange Commission (SEC).

Yes, users own the cryptocurrencies held on Robinhood and they are kept in cold storage with crime insurance.

Yes, Robinhood is available to use in the USA.

Robinhood is a good option for beginners, but it has limited cryptocurrency options.

No, Robinhood does not charge any monthly fees for its basic account, but there is a subscription fee for the Robinhood Gold account.

Robinhood Verdict

As an esteemed economist with a keen interest in finance and technology, it’s my pleasure to weigh in on this new bitcoin trading tool. After analyzing the provided texts, I’m happy to say that this tool is a valuable asset for anyone looking to invest in cryptocurrencies.

The fact that it allows for commission-free trading is a huge plus, especially for those who are just starting out in the world of investing. This can help to minimize the risk of loss, and ensure that your profits are maximized.

Furthermore, the tool provides a simple, user-friendly platform that is easy to navigate, even for those who are not tech-savvy. This can help to make the process of trading bitcoin less intimidating and more accessible for everyone.

The platform’s regulation by the U.S SEC and membership of FINRA provides users with the assurance that their investments are safe and secure. This is crucial, given the potential risks that come with trading cryptocurrencies.

It’s important to note that the tool’s lack of transparency in connection with the PFOF strategies it utilizes while trading is a cause for concern. However, regulatory authorities such as the Securities and Exchange Commission are taking steps to address this issue. It’s a positive sign that the industry is moving towards greater transparency and accountability.

In conclusion, this bitcoin trading tool is a valuable resource for anyone looking to invest in cryptocurrencies. While there are some concerns around transparency, the benefits of commission-free trading, a user-friendly platform, and regulatory oversight outweigh these concerns. I would recommend this tool to anyone looking to dip their toes into the exciting and ever-evolving world of cryptocurrency investing.

Register with Robinhood today and use the free trial verion.

Ad Disclosure

BitLQ

BitLQ  Trading Platform Setoro

Trading Platform Setoro  Trading OX

Trading OX  Toro Stocks

Toro Stocks  The Secret Crisis Blueprint

The Secret Crisis Blueprint  TeslaX

TeslaX  Techopedia Quantum Flash

Techopedia Quantum Flash  Success LP

Success LP  Stock Investing

Stock Investing